-

- Sopto Home

-

- Special Topic

-

- Fiber Optics knowledge

-

- Using Dark Fiber for Low-Latency Tradin

Fiber Optics knowledge

- Maintained Methods of Fusion Splicer Parts

- How to Use the Fiber Optic Cleaver?

- What are Fixed Attenuators & Variable Attenuators?

- Deployable Fiber Optic Systems for Harsh Mining Environments

- Developing Miniature Fiber Optic Cable Has Become the Trend

- Fiber Optic Cleaning Procedures

- 6 Steps to Selecting a Fiber Optic Cable

- Signal Attenuation Introduction

- How Fiber Transmission Works?

SOPTO Special Topic

Certificate

Guarantee

Except products belongs to Bargain Shop section, all products are warranted by SOPTO only to purchasers for resale or for use in business or original equipment manufacturer, against defects in workmanship or materials under normal use (consumables, normal tear and wear excluded) for one year after date of purchase from SOPTO, unless otherwise stated...

Return Policies

Defective products will be accepted for exchange, at our discretion, within 14 days from receipt. Buyer might be requested to return the defective products to SOPTO for verification or authorized service location, as SOPTO designated, shipping costs prepaid. .....

Applications

Fiber Optis can be used in so many fields:

Data Storage Equipment

Interconnects,Networking

Gigabit Ethernet

FTTx, HDTV,CATV

Aerospace & Avionics

Data Transfer Tests

Network Equipment

Broadcast Automotive

Electronics,Sensing

Oil & Gas, Imaging

Outside Plant,Central Office

Harsh Environment

Data Transmission

Illumination,Institutions

Ship to Shore,Education

Simulation,Military,Space

Unmanned Aerial Vehicles

Semiconductor Equipment

Diagnostics & Troubleshooting

Premise Networks Carrier Networks

Independent Telecommunication Providers

SOPTO Products

- Fiber Optic Transceiver Module

- High Speed Cable

- Fiber Optical Cable

- Fiber Optical Patch Cords

- Splitter CWDM DWDM

- PON Solution

- FTTH Box ODF Closure

- PCI-E Network Card

- Network Cables

- Fiber Optical Adapter

- Fiber Optical Attenuator

- Fiber Media Converter

- PDH Multiplexers

- Protocol Converter

- Digital Video Multiplexer

- Fiber Optical Tools

- Compatible

Performance Feature

Fiber Optics knowledge

Recommended

Using Dark Fiber for Low-Latency Trading

The trading firm or investment bank that needs to connect buildings to support a low-latency trading strategy has a range of approaches to evaluate in relation to its unique situation.

The financial company might consider a fully managed service in order to minimize operational hassle and lower monthly costs. It might consider a fractional/“dim” service offering in order to strike the appropriate balance among burden, control and costs. Or, it might assess the tremendous business opportunity, fierce competition and rapid pace of technology innovation around low-latency trading and discern that using a private, dark-fiber network is the only sufficient, future-proofing solution for its environment.

Certainly, the business case for going the dark fiber route grows more compelling as a financial company delves deeper and deeper into the low-latency game. For starters, the availability of dark fiber has expanded, and its cost has dropped. Even more importantly, the manic competition within the various forms of electronic trading (especially high-frequency trading and market making) has forced trading firms and investment banks to pursue even the slimmest of improvements in latency along the routes connecting trading venues and information sources.

Many optical networks have not been optimized for latency. Traditional telecommunication networks, for example, tend to build networks with many local stops—often along railroad routes—between cities because each stop provides additional opportunities to monetize services. Unfortunately for traders, each stop also produces latency. Similarly, many optical networks have been built with plenty of slack fiber coils along the way in order to allow for quicker, simpler route restoration in the event of fiber cuts or other issues. Those coils, too, add latency to a path.

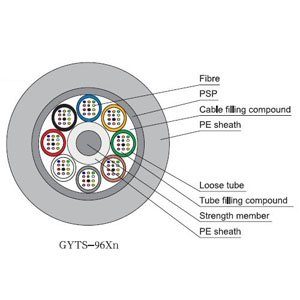

Loose Tube Outdoor Optical cable

In creating a private, completely protocol-agnostic, dark-fiber infrastructure, the financial customer can select the ideal fiber paths and choose and configure its own equipment to ensure lowest-latency performance. This gives the company complete flexibility to take advantages of new advances in the enabling optical technologies. Innovation in low-latency technologies such as transponders, amplifiers and regenerators has been rapidly paced in recent years—resulting in massive latency reduction for the prized, Chicago-to-New York trading route, for example. If contracting with a provider of a low-latency service, the customer is to varying degree dependent on its partner’s willingness to procure, deploy and integrate such innovations.

Furthermore, while the monthly cost of a private dark-fiber infrastructure will turn off some trading firms and investment banks, the incremental cost and delay associated with turning up additional wavelengths is relatively small. The financial company becomes more fluid to respond and grow to capitalize on emerging business opportunities, as connections can be provisioned and activated as needed. And there’s zero potential for interference and latency caused by other sources of traffic.

In fact, there are good arguments for all three possible approaches to under girding a low-latency trading strategy: contracting for a fully managed service, opting for a fractional/dim offering or using a private, dark-fiber network. An individual trading firm or investment bank might even find applicability for multiple approaches to achieve the range of its business goals.

For more info, please contact a Sopto representative by calling 86-755-36946668, or by sending an email to info@sopto.com. Or, you are able to just browse our website.

-180x180.JPG)